Bitcoin remains the centerpiece of the global crypto market, and as we approach 2026, both traders and investors are eager to understand where BTC might head next. This analysis combines recent market performance, technical indicators, and key fundamentals to form a realistic Bitcoin 2026 price outlook.

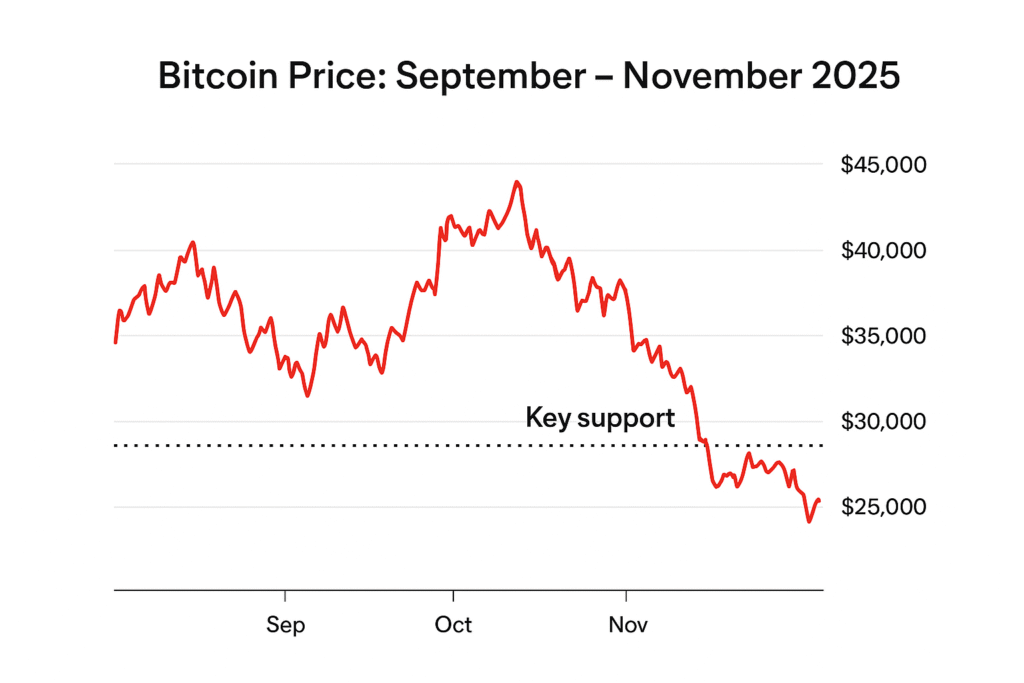

📊 Bitcoin Market Overview (September – November 2025)

The last two months showcased extreme volatility, reflecting a strong battle between bullish optimism and bearish resistance.

September 2025: Consolidation Amid Market Uncertainty

Bitcoin attempted to consolidate after earlier movements but remained sensitive to global macroeconomic trends. Several recovery attempts were rejected near critical resistance zones, highlighting fragile market confidence.

October 2025: Local Peak and Fast Correction

A short-term rally occurred, likely triggered by institutional news or positive regulatory signals. However, the rally quickly faded as selling pressure intensified near upper resistance levels.

November 2025: Start of a Correction Phase

At the start of November, Bitcoin broke below key support areas — signaling profit-taking and potential reaction to broader financial market changes.

Summary:

BTC traded sideways with a slightly bearish tone. The latest correction phase emphasizes the importance of watching support levels heading into 2026.

🔍 Bitcoin Technical Analysis for 2026

Technical indicators point to critical levels that could define Bitcoin’s performance in 2026.

Key Support Levels

Short-Term Support: Around $35,000 — losing this level could trigger deeper corrections.

Macro Support: Between $30,000 – $28,000 — breaking this zone could mark the start of another extended crypto winter.

Key Resistance Levels

Primary Resistance: Near $42,000 — a breakout would signal renewed bullish momentum.

Psychological Barrier: Around $50,000 — breaking above would confirm a full bull market setup.

Technical Outlook:

If Bitcoin maintains macro support at the end of 2025, 2026 could bring a push toward new all-time highs. Failure to hold could result in range-bound accumulation rather than strong rallies.

🌍 Fundamental Analysis: What Could Drive Bitcoin in 2026

While technical signals guide short-term movements, Bitcoin’s fundamentals continue to strengthen.

1. Institutional Adoption

The global rollout of spot Bitcoin ETFs and rising interest from pension funds and corporate investors may become the main drivers of BTC’s growth in 2026. Institutional inflows typically stabilize volatility and boost long-term confidence.

2. Macroeconomic Policy

U.S. Federal Reserve decisions on interest rates and inflation control will directly affect Bitcoin’s attractiveness as a hedge asset. A potential shift toward monetary easing in 2026 could trigger renewed capital inflows into crypto.

3. Bitcoin Halving Effect

The last Bitcoin halving (in [insert date]) continues to shape supply dynamics. Historically, BTC price increases 12–18 months after halving, which perfectly aligns with 2026 — a year that could witness the delayed bullish impact.

Bitcoin 2026 Price Forecast: Will BTC Reach New Highs?

Despite short-term price swings, long-term fundamentals remain strongly bullish.

Predicted Scenario:

H1 2026: Gradual price recovery fueled by institutional demand and post-halving supply tightening.

H2 2026: Possible parabolic phase if macroeconomic conditions stabilize and mainstream media attention returns, driving retail investor participation.

Conclusion

The Bitcoin 2026 forecast looks cautiously optimistic. Backed by strong fundamentals, post-halving supply reduction, and increasing institutional participation, BTC may be heading toward another major bull cycle.

For investors who want to start trading or accumulating Bitcoin early, consider doing it through a trusted exchange such as

Binance — one of the world’s largest and most secure crypto platforms.

If Bitcoin maintains its key support zones and global macro conditions remain stable, a new all-time high before the end of 2026 remains a realistic scenario.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Litecoin

Litecoin  PayPal USD

PayPal USD  Sui

Sui  USDT0

USDT0  Ethereum Classic

Ethereum Classic