Welcome to January 2026. Looking back at 2025, it was the year Ethereum finally proved its critics wrong. While many argued that Layer 2 networks (L2s) would “drain” value from the mainnet, we’ve seen the opposite: Ethereum has successfully transitioned into the Global Settlement Layer.

With the Pectra and Fusaka upgrades now fully operational, and the 2026 Glamsterdam hard fork on the horizon, the question isn’t whether Ethereum will grow, but how high the ceiling really is.

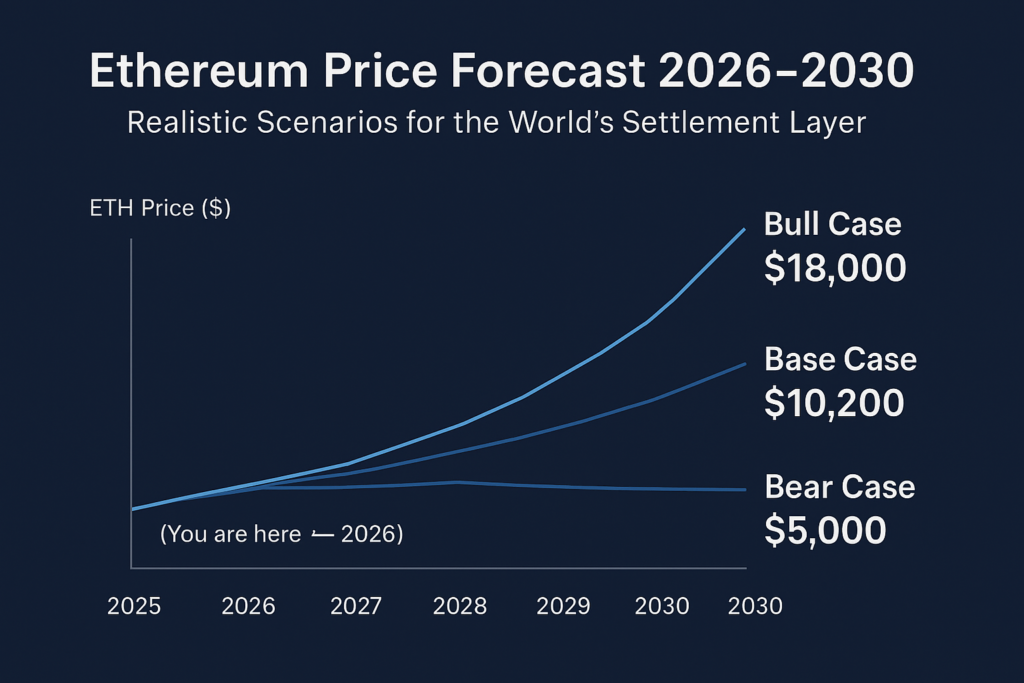

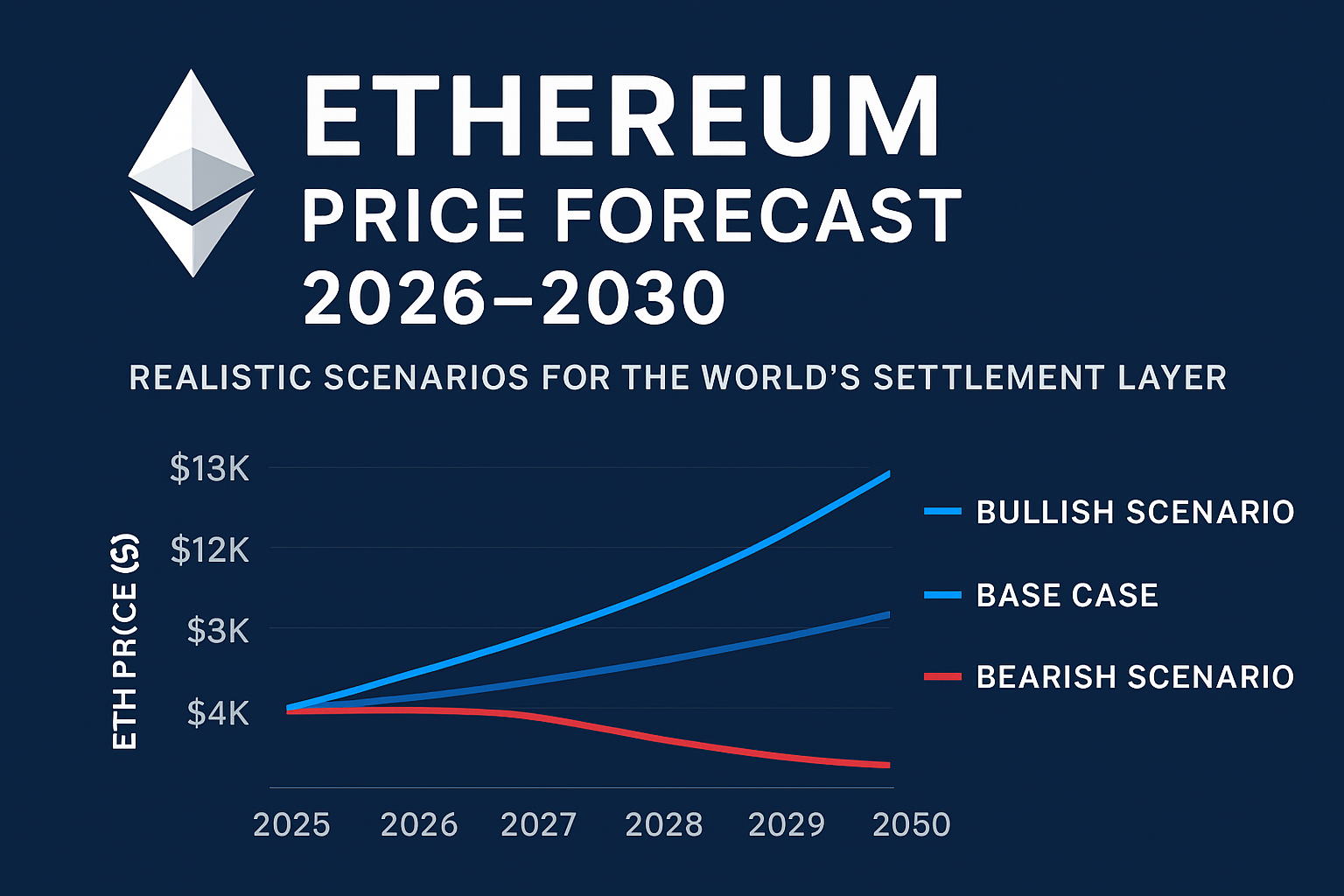

In this guide, we break down the three most realistic price scenarios for ETH between now and 2030.

The Foundation: Why 2026 is Different

Unlike the speculative bubbles of the past, Ethereum’s value in 2026 is driven by three measurable pillars:

Massive Throughput: L2s like Base and Arbitrum are now processing over 15 million transactions per day, while L1 fees remain stable thanks to “blobs” (EIP-4844).

The Supply Crunch: The burn mechanism (EIP-1559) has made ETH consistently deflationary during high-activity periods.

The current supply dynamics can be expressed as:

Delta S = I – BWhere Delta S is the change in supply, I is issuance, and B is the burn rate. In 2025, B frequently exceeded I.

Institutional Staking: Spot ETFs have matured. Major banks are no longer just “holding” ETH; they are staking it to capture the 3–4% “Internet Bond” yield.

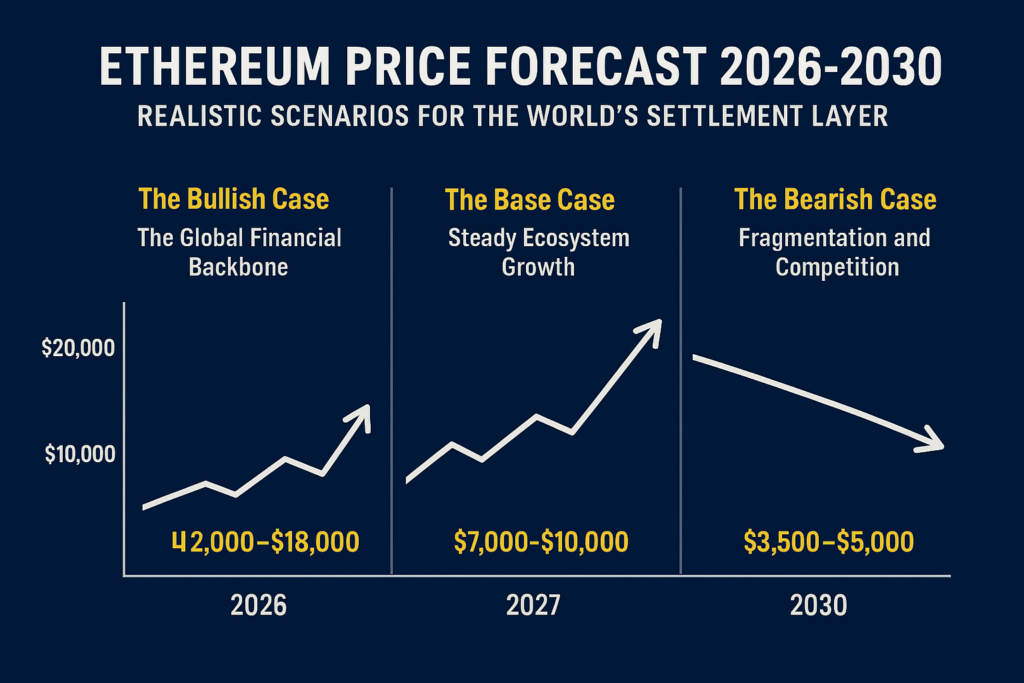

Scenario 1: The Bullish Case – “The Global Financial Backbone”

Price Target 2030: $12,000 – $18,000

In this scenario, Ethereum becomes the primary rails for Tokenized Real-World Assets (RWAs).

The Driver: BlackRock and other giants move trillions in money market funds onto the Ethereum L1.

The Outcome: The “Triple Halving” effect (reduced issuance, staking lockups, and high burn) creates a supply shock. If Ethereum captures even 10% of global settlement volume, five-figure ETH is a mathematical probability.

Scenario 2: The Base Case – “Steady Ecosystem Growth”

Price Target 2030: $7,000 – $10,000

This is the most likely scenario, where Ethereum remains the dominant platform for DeFi and NFTs but faces healthy competition.

The Driver: Continued L2 expansion and the successful 2026 Glamsterdam upgrade, which brings parallel processing to the EVM.

The Outcome: ETH tracks the growth of the broader tech market but with higher volatility. It outperforms Bitcoin in percentage gains due to its utility.

Scenario 3: The Bearish Case – “Fragmentation and Competition”

Price Target 2030: $3,500 – $5,000

In this scenario, the “L2 fragmentation” problem persists. Users find it too difficult to move between different rollups, and high-performance L1s like Solana or Monad capture the lion’s share of new retail users.

The Driver: Regulatory hurdles in the US/EU and a lack of interoperability between Ethereum layers.

The Outcome: ETH remains a “store of value” for the crypto elite but loses its status as the “Global Computer.”

Projected Price Table: 2026–2030

| Year | Bear Case (Low) | Base Case (Realistic) | Bull Case (High) |

| 2026 | $2,800 | $4,500 | $6,200 |

| 2027 | $3,200 | $5,800 | $8,500 |

| 2028 | $4,100 | $7,200 | $11,000 |

| 2029 | $3,800 | $8,900 | $14,500 |

| 2030 | $4,500 | $10,200 | $18,000+ |

Visualizing the Growth: 2026–2030 Trend

ETH Price ($)

^

| / (Bull: $18k)

| /

| /

| ____________/ (Base: $10k)

| ___________/

| ________/ (You are here - 2026)

| / (2025 Correction)

|/

+------------------------------------------------------>

2025 2026 2027 2028 2029 2030

Key Technical Milestones to Watch

To achieve the “Base Case” or “Bull Case,” Ethereum must hit these roadmap milestones:

Verkle Trees (2026-2027): This will allow for “stateless clients,” making it possible to run an Ethereum node on a smartphone. This is the ultimate decentralization goal.

L2 Interoperability: The industry must solve the “fragmentation” problem. If you can’t send USDC from Arbitrum to Base instantly and for free, the user experience will suffer.

EIP-7702 (Account Abstraction): This was the star of 2025. It allowed traditional email logins for crypto wallets. Continued adoption here is vital for onboarding the next billion users.

Conclusion: Is Ethereum Still a Good Buy in 2026?

As of early 2026, Ethereum is no longer a “start-up” blockchain. It is an established financial utility. While it may not provide the 100x returns of a micro-cap meme coin, its risk-adjusted return profile remains one of the best in the global market.

If you believe that the future of finance is on-chain, and that institutions want a secure, decentralized, and ESG-friendly settlement layer, then ETH is the cornerstone of that future.

FAQ: Ethereum in 2026-2030

1. Will Solana kill Ethereum? By 2026, it’s clear that both will coexist. Solana has won the “high-speed retail” market (gaming, social), while Ethereum has secured the “high-value institutional” market (settlement, RWAs, large-scale DeFi).

2. Is ETH deflationary right now? Yes. Since the Fusaka upgrade in late 2025, the increased activity on L2s has driven enough L1 blob demand and fee burning to keep the supply slightly decreasing annually.

3. What is the safest way to hold ETH until 2030? For long-term holders, Liquid Staking (LSTs) or Restaking (EigenLayer) remains popular, but always ensure you are using a decentralized provider or holding your own keys in cold storage.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Litecoin

Litecoin  PayPal USD

PayPal USD  Sui

Sui  USDT0

USDT0  Ethereum Classic

Ethereum Classic