Are you dreaming of financial freedom but feel like investing is only for the wealthy? Think again! The modern financial world has opened its doors to everyone, regardless of their starting balance. You can start investing effectively, even with a small budget—sometimes as little as 10$ to 50$.

You’re standing at a critical crossroads: Stocks or Cryptocurrency? Both options offer potential growth when starting small, but they come with fundamentally different risk profiles and learning curves.

This comprehensive SEO guide will break down how to start investing with minimal capital, compare the benefits and drawbacks of stocks versus crypto for small budgets, and provide a clear, step-by-step action plan to help you confidently build your financial future.

Why Starting Small Is the Best Strategy (Don’t Wait!)

Many people postpone investing, waiting for a “large sum” or the “perfect moment.” This delay is often the biggest mistake. Even 50$ a month can turn into substantial capital over time, thanks to two powerful forces:

1. The Power of Compounding

Compounding interest is the phenomenon where your earnings begin to generate their own earnings. Over long periods, especially in the stock market, this effect exponentially increases your capital. By starting earlier, even with a tiny amount, you give your money more time to work.

Formula Insight: The future value (FV) of an investment can be calculated using the compound interest formula:

FV = P(1 + r)^nWhere P is the principal investment, r is the annual interest rate, and n is the number of periods. A larger $n$ (more time) dramatically increases FV.

2. Discipline and Learning

Investing with a small budget is the ideal training ground. It allows you to:

-

Practice emotional control: Learn to handle market dips without panic selling.

-

Test strategies: Experiment with different asset allocations or investment styles.

-

Build financial discipline: Master the habit of regular contributions (Dollar-Cost Averaging).

Key Takeaway: Don’t wait until you can invest 1,000$. The best time to start was yesterday. The next best time is today.

Step 1: Defining Your “Small Capital” and Freeing Up Funds

Before investing, you need to know how much you can afford to lose. For this guide, “small capital” refers to an amount between 10$ and 500$ that you can invest regularly.

1. The Financial Foundation: Budgeting

Track Your Spending: Analyze where your money goes. You might be surprised how much is spent on unnecessary items (daily coffee, unused subscriptions, impulse buys).

Adopt the 50/30/20 Rule (as a starting point):

50% — Needs (Rent, groceries, utilities).

30% — Wants (Entertainment, dining out).

20% — Savings & Investments.

Automate It: Set up an automatic transfer of your chosen investment amount (e.g., 50$) to your brokerage or crypto exchange account immediately after payday. Pay Yourself First!

2. Establish an Emergency Fund (The Must-Have)

Crucial Warning: Never invest money you might need soon. Before you start, you must have an Emergency Fund—a liquid stash (kept in a savings account or money market fund) covering 3-6 months of your essential living expenses. This prevents you from being forced to sell your investments at a loss during a financial emergency.

Stocks vs. Cryptocurrency: Comparison for the Small Investor

When you have limited capital, your choice of asset class becomes critical. Let’s compare the two most popular options.

| Feature | 📈 Stocks (Equities) | 💎 Cryptocurrency (Crypto Assets) |

| Risk & Volatility | Moderate to High. Generally lower volatility than crypto. | Extremely High. Massive price swings are common. |

| Regulation | High. Heavily regulated by government bodies (SEC, FCA, etc.). | Low to Developing. Regulations vary widely by country. |

| Liquidity (Ease of Selling) | Very High. Easy to buy and sell during market hours. | High. 24/7/365 trading. |

| Minimum Investment | Very Low, thanks to Fractional Shares. | Very Low. Can buy fractions of a coin (e.g., $0.001$ BTC). |

| Long-Term Track Record | Decades of historical data showing reliable growth (average $8-10\%$ per year). | Short. Highly speculative, but with massive growth potential for early adopters. |

| Ideal for Small Capital? | YES. Lower risk, higher stability for beginners. | YES, but only with high risk tolerance. High potential returns, but greater risk of loss. |

Option 1: Investing Small in the Stock Market

The stock market is often the preferred starting point for long-term wealth building due to its relative stability and historical track record.

Why Stocks Are Great for Small Budgets

1. Fractional Shares

This innovation is a game-changer for small investors. Brokerages now allow you to buy tiny fractions of expensive stocks.

Example: You want to invest in a company whose share price is 1,500$. With only 50$, you can buy 0.033$ of a share. This makes blue-chip stocks accessible to everyone.

2. Exchange-Traded Funds (ETFs)

ETFs are funds that hold a basket of assets, often tracking a specific index, like the S&P 500. This provides instant, cheap diversification.

For the Small Investor: Instead of trying to pick one winning stock, you can buy a single share of an ETF like VOO (tracks S&P 500) or VT (tracks the global market). Your 50$ investment is instantly spread across 500+ companies. This is the gold standard for beginner, small-budget investors.

Action Plan for Small-Cap Stock Investors

Choose a Brokerage: Select a commission-free brokerage that offers fractional shares (e.g., Fidelity, Interactive Brokers, Robinhood, or local equivalents).

Start with ETFs: Commit to investing your monthly small capital into one or two broad-market ETFs. Examples:

VTI or ITOT(Total U.S. Stock Market)

VXUS or IXUS (International Stock Market)

Implement DCA: Set a fixed amount (e.g., 100$) to be invested on the same day every month, regardless of market prices. This strategy (Dollar-Cost Averaging) mitigates the risk of buying at the market peak.

Option 2: Investing Small in the Cryptocurrency Market

The crypto market is exciting, offers the potential for 10x returns, but is vastly more volatile and less regulated.

Why Crypto Attracts Small Investors

1. Accessibility

Cryptocurrencies are divisible. You don’t need 60,000$ to buy Bitcoin; you can buy 10$ worth of BTC, which is 0.00016$ BTC.

2. High-Risk, High-Reward Potential

For a small investor who can afford to lose a small portion of their capital, crypto offers asymmetric risk—the potential for exponential gains far outweighs the investment amount. However, the probability of complete loss is also significantly higher than with stocks.

The Fundamental Risks of Crypto

Volatility: A 20-30% drop in a single day is not uncommon. This can be emotionally taxing and lead beginners to sell at the worst time.

Regulation & Security: The industry is still maturing, posing risks from exchange hacks, scam projects, and uncertain government regulations.

Action Plan for Small-Cap Crypto Investors

Allocate a Small Percentage: Never allocate more than 5-10% of your total investment capital to high-risk assets like crypto. If your total investment budget is 100$ a month, allocate only 5$ – 10$ to crypto.

Use Reputable Exchanges: Sign up for well-known, regulated exchanges (e.g., Coinbase, Binance, Kraken).

Focus on Blue-Chips: Stick to the most established, high-market-cap assets:

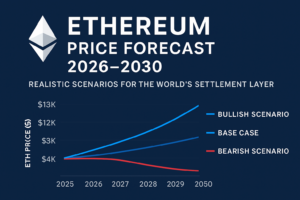

Bitcoin (BTC): The digital gold, typically the most stable.

Ethereum (ETH): The leading platform for decentralized applications.

DCA is Essential: Due to high volatility, DCA is even more critical in crypto. Never try to “time the market.”

The 5-Step Beginner’s Action Plan

Follow this plan to successfully launch your small-capital investment journey:

Step 1: Secure Your Foundation

Establish your 3-6 month Emergency Fund.

Determine your fixed monthly investment amount (e.g.,100$).

Step 2: Choose Your Assets & Strategy

Recommendation: Dedicate 90% of your capital to low-cost ETFs (Stocks).

If you have high risk tolerance, dedicate 10% to Bitcoin or Ethereum (Crypto).

Step 3: Open Accounts

Open an account with a reputable, commission-free brokerage (for stocks/ETFs).

Open an account on a major crypto exchange (if choosing crypto).

Step 4: Implement Dollar-Cost Averaging (DCA)

Set up automatic transfers from your bank account to your investment account.

Automate the purchase of your chosen ETF or crypto on the same day each month.

Step 5: Forget About It (Long-Term Mindset)

The hardest part is not looking at your balance daily. Market fluctuations are normal.

Your small capital investments are for the long run (5-10+ years). Consistency, not market timing, is the key to success.

You don’t need to be rich to start investing, but you do need to start investing to become rich. Begin your journey today!

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Litecoin

Litecoin  PayPal USD

PayPal USD  Sui

Sui  USDT0

USDT0  Ethereum Classic

Ethereum Classic