XRP is not just a cryptocurrency; it is an asset closely integrated with RippleNet and Binance a payment network designed for financial institutions. Its 2026 outlook depends on three main pillars: regulatory status, fundamental utility, and technical performance.

⚖️ Fundamental Analysis: The Decisive Factor (SEC vs Ripple Case)

Unlike most cryptocurrencies, XRP’s price has been tightly linked to the SEC lawsuit against Ripple Labs for years. Understanding this case is crucial for predicting its 2026 trajectory.

| Factor | Expected 2026 Status | Price Impact |

|---|---|---|

| Regulatory Clarity | Full or near-complete resolution of the SEC case. Partial victories already confirmed that XRP token sales are not securities sales. | Very Positive. Removing legal uncertainty allows XRP to return to major US exchanges and attract institutional capital (e.g., Spot XRP ETFs). |

| RippleNet & ODL (On-Demand Liquidity) | Continued expansion, especially in Asia, the Middle East, and Latin America. XRP serves as a “bridge” for fast, low-cost cross-border payments. | Positive. Increasing real-world use drives demand among financial institutions, boosting fundamental value. |

| Supply & Distribution | Ripple continues monthly releases from escrow (usually 1 billion XRP), some of which are recycled. | Neutral-Negative. Large, controlled supply prevents parabolic price surges seen in low-supply assets like Bitcoin post-halving. |

| Potential XRP ETFs | If the SEC case resolves favorably, Spot XRP ETFs could be filed and approved in the US. | Extremely Positive. Opens the asset to billions in institutional capital. |

Fundamental Takeaway: If legal uncertainty disappears, XRP’s value as a global payment asset could become the main price driver in 2026, potentially outperforming the broader altcoin market.

📈 Technical Analysis: Key Levels for 2026

XRP has long been in an accumulation phase due to regulatory risk. With clarity on the legal front, attention shifts to historical levels:

| Direction | Level | Significance |

|---|---|---|

| Major Support | $0.50 – $0.60 | Critical support zone. Holding this level indicates strong bullish sentiment. |

| First Resistance | $0.80 – $0.90 | Breaking this may trigger rapid move toward triple-digit pricing (in cents). |

| Psychological Barrier | $1.00 | Key psychological level. Closing above $1.00 could bring retail investors back in force. |

| Long-Term Target | $2.00 – $3.00+ | Historical support/resistance zone (2018 & 2021). Next target if a bullish trend begins. |

Technical Outlook: A breakthrough of resistance levels maintained since the partial SEC victory would confirm a bullish trend. 2026 could be the year XRP tests its historical highs.

🔮 XRP Price Forecast for 2026

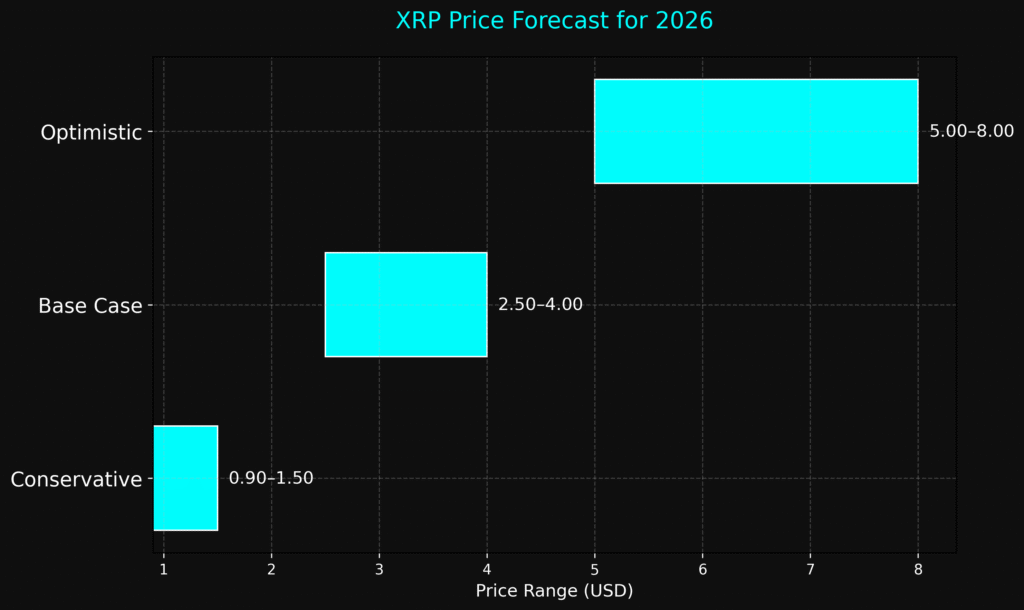

Combining strong fundamentals (SEC resolution, global adoption) with a potential bullish crypto market cycle, the following scenarios emerge:

| Scenario | Conditions | Forecasted Price Range (End of 2026) |

|---|---|---|

| Conservative | SEC case delays or ends with restrictions; overall market remains consolidated. | $0.90 – $1.50 |

| Base Case (Most Likely) | SEC case ends positively; XRP returns to all exchanges; institutional ODL usage grows. | $2.50 – $4.00 |

| Optimistic (Mega-Bull) | Full Ripple victory and Spot XRP ETF approval; crypto market hits peak bull cycle. | $5.00 – $8.00+ |

Special Note: Some analysts predict that full removal of regulatory risk could push XRP above $6.80, making it one of the most regulated and institutionally adopted altcoins on the market.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Litecoin

Litecoin  PayPal USD

PayPal USD  Sui

Sui  USDT0

USDT0  Ethereum Classic

Ethereum Classic